Author: Melina Scheuber

In Switzerland, approximately 60% of women are employed part-time, compared to around 18% of men [1]. This model is increasingly popular, especially among women under 30 [2].

Various factors contribute to this trend: leisure, education, work-life balance, and predominantly, domestic responsibilities, particularly childcare [3]. Many Swiss women find this model more feasible than full-time work due to the challenges of balancing work and family life, alongside negative tax incentives for second incomes, lower wages, and societal role expectations.

Effects of Part-Time Work on Retirement Provision

Working fewer hours typically results in a lower salary, which in turn leads to reduced contributions to the pension scheme (1st and 2nd pillar). This decrease in contributions to the AHV and pension fund consequently diminishes retirement pensions and insurance benefits.

Our pension system is intricate, with many personalized options based on factors like marital status, parenthood, or care credits.

Pension Provision for Women – Urgent Need for Action!

Pillar 1: AHV

The AHV retirement pension amount depends on the number of contribution years and average annual income, including child-raising or care credits.

The maximum single person’s pension is CHF 2,390 monthly (as of 2022[4]),

with a minimum of CHF 1,195. Married couples collectively receive up to 150% of the single person’s pension.

Non-working married individuals are co-insured under the OASI scheme through their working partner, provided the partner contributes at least twice the minimum OASI amount annually, currently CHF 1,006 (2 x CHF 503).

Pillar 2: Occupational Pension Provision (Pension Fund)

Part-time work significantly impacts the pension fund more than the 1st pillar.

Anyone earning a minimum of CHF 21,510 (CHF 1,792.50 per month) is covered by the pension fund.

Unlike the 1st pillar’s pay-as-you-go system, the 2nd pillar allows you to accumulate your retirement capital while providing risk insurance for scenarios like death or disability. The benefits depend on your insured salary and your employer’s pension fund plan.

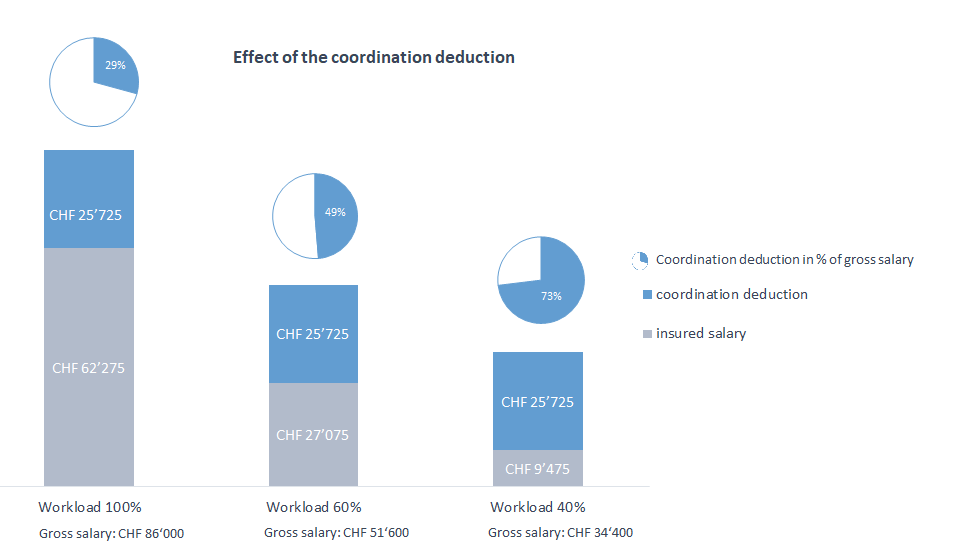

An essential factor is the coordination deduction (CHF 25,095), which impacts part-time workers more significantly.

This deduction represents the income portion already covered by AHV to avoid double insurance. It is subtracted from your gross salary to calculate your insured salary.

Your retirement and risk contributions, based on your insured salary, combine to form the monthly social security deductions from your salary. These contributions, along with annual interest, accumulate to form your direct pension capital. The insurance component covers risks like illness, accident, or death.

As evident, a lower insured salary results in reduced retirement savings and lesser insurance benefits in the event of the aforementioned scenarios.

Tipps for making proper provisions while working part-time

Seek Specialist Advice

Before reducing your work hours, have a specialist evaluate the financial impact on your pension and insurance benefits to avoid unexpected financial issues.

Check Your Pension Fund Benefits

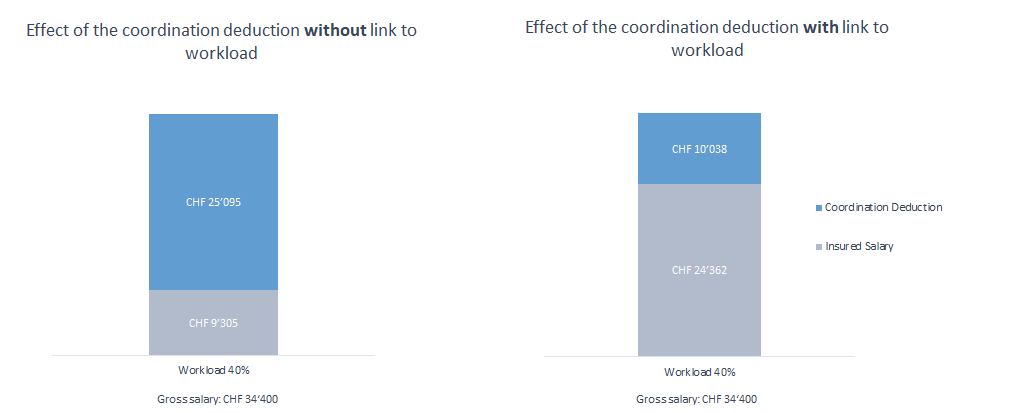

Some employers adjust the pension fund entry threshold and coordination deduction based on workload, thereby potentially reducing the coordination deduction and increasing your insured salary. Inquire with your pension fund about how these factors are managed for part-time workers.

Be Cautious with Multiple Part-Time Jobs

If you have multiple employers with a total annual salary exceeding the pension fund’s minimum income threshold (CHF 21,510), you should either consolidate your pension funds with one employer or affiliate with the “Stiftung Auffangeinrichtung BVG,” mandated by the federal government.

Avoid Double Coordination Deductions

If insured with pension funds from multiple jobs, ensure that the coordination deduction is only applied once by having both incomes insured through one pension fund.

Utilize Pillar 3a Opportunities

Pillar 3a is ideal for bridging gaps in occupational pension provision and offers tax-privileged savings for retirement. If unable to contribute financially, consider your partner’s support.

Consider Securities Investments

Apart from pillar 3a, explore securities investments for attractive long-term returns, as they can offer better yields than traditional savings accounts.

Maintain Financial Independence

The Swiss Conference of Gender Equality Commissioners advises against reducing workloads below 70% long-term to prevent pension cuts. Regardless of marital status, actively manage your finances to ensure sufficient retirement provision.

Take Control of Your Finances Today

How does this resonate with you?

Would you like to be informed once Melina Scheuber or her colleagues publish articles around pension fund and financial topics ?

Please sign up for our newsletter.

You are currently viewing a placeholder content from HubSpot. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

[1] Part-time work | Federal Statistical Office

[2] Labor Market Statistics – Part-time work is particularly popular among young women

[3] KOF: Analysis of Part-time Work in Switzerland

[4] All figures are gross values for the year 2022.